The complicated financial elements at work in our trade are impacted by many exterior forces. Even with all the info we acquire for this survey, the longer term is not a positive factor. We make forecasts and predictions, and everybody can have their say about what may occur subsequent, however there are all the time surprises.

Click on to view the person Prime 50 by class:

For example, final 12 months for the TC 2024, which economically was primarily based on information from the CY 2023, the trade contracted. That is smart while you bear in mind current financial historical past. In June of 2022, the inflation fee peaked at 9.1% and that was when everybody was practically in a panic.

It’s clearer now that the ramifications from that inflationary spike carried via your complete 2023 season which adopted it. Industrial, residential, and personal markets took a confidence hit. With all of the uncertainty and concern that the inflation may relax up at any second, 2023 was a 12 months that folks performed it secure.

As inflation regularly got here down, and hit it is lowest in December of 2024 at 2.9% confidence clearly improved, as a result of though it was an election 12 months, which frequently drives extra conservative enterprise choices, the CY 2024 season — and subsequently the TC 2025 survey — reveals, maybe, the most important total development in a twelve month interval.

Whereas I used to be engaged on this evaluation, one contractor known as me, and once I talked about how good final 12 months’s development was, his quick reply was, “Yeah, we’ll most likely see a correction to that this season.” I added that right here, as a result of I’m to see if his prediction comes true.

However both manner, proper now we will have fun an unimaginable 12 months for the pavement upkeep trade.

Total Gross sales Totals

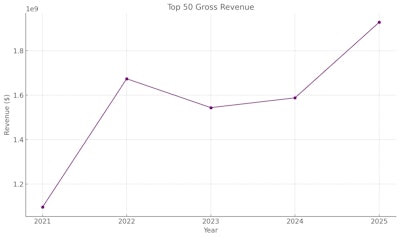

The compound annual development fee (CAGR) for the Prime 50 Gross Income from 2021 to 2025 is roughly 15.17% per 12 months. This robust development displays a strong restoration and an total upward development within the sector, because the trade continues to rebound from pandemic-related disruptions.

The rise in gross income over the previous few years is pushed by each the rebound of the pavement trade and contractors adapting to new market situations and alternatives. Regardless of some fluctuations, the long-term development trajectory signifies a sector that’s poised for continued growth within the years to come back.

Wanting particularly on the change from TC 2024 to 2025, we see a big enhance in gross income. The whole income for TC 2025 stands at $1.928 billion, marking a 21.41% development from the $1.588 billion in TC 2024.

This development represents a rise of $340 million from the earlier 12 months, signaling a robust surge in enterprise for the Prime 50 contractors. This sharp rise underscores the resilience of the sector, with TC 2025 probably benefiting from a extra favorable financial atmosphere and elevated demand for pavement-related providers as infrastructure spending continues to develop.

Let’s briefly study every class’s gross complete income numbers:

- Paving Prime 50: $1.906 billion in 2025 complete gross sales in comparison with $1.614 billion in 2024

- Striping Prime 50: $1.827 billion in complete gross sales in comparison with $1.435 billion in 2024

- Sealcoating Prime 50: $1.811 in complete gross sales in comparison with $1.448 billion in 2024

- Pavement Restore Prime 50: $1.698 in complete gross sales in comparison with $1.544 billion in 2024

Whereas all of this, on the floor, reveals robust development throughout, while you break down the monetary information per phase, there was nonetheless one class that contracted, and did so for the second 12 months in a row. That was the Paving-Solely class:

- Paving-Solely gross sales dropped to $698,446,768 in comparison with $844,813,039 in 2024

- Striping-Solely gross sales exploded to $134,120,870 in comparison with the $89,944,736 generated in 2024

- Sealcoat-Solely gross sales noticed wholesome development to $165,760,074 in comparison with $152,812,614 in 2024.

- Pavement Restore-Solely gross sales completely crushed it by virtually doubling to $557,230,541 from the earlier all-time excessive of $285,633,743 in 2024

The Common Prime 50 Contractor

Extra excellent news, nonetheless, was that the common contractor in our Prime 50 generated $38 million in gross complete gross sales, which was $6 million greater than final 12 months’s common of $32 million, and simply narrowly surpasses the earlier peak of TC 2023’s $35 million common.

The Prime 50’s segmented common income stream breakdown is as follows:

- Paving: 42% (49% 2024)

- Striping: 12% (10% 2024)

- Sealcoat: 12% (12% in 2024)

- Pavement Restore 22% (18% in 2024)

- Different: 11% (9% in 2024)

- Floor Therapies: 1% (>1% in 2024)

The typical contractor’s time was cut up up as follows:

- Driveways: 7% (4% in 2024)

- Highways: 6% (3% in 2024)

- Parking Tons: 62% (72% in 2024)

- Residential/Metropolis Roads: 20% (17% in 2024)

- Different: 4% (4% in 2024)

The typical contractor’s buyer combine broke down as follows:

- Industrial/Industrial: 57% (60% in 2024)

- Municipal: 17% (13% in 2024)

- Multi-family/HOA/and so forth: 19% (19% in 2024)

- Single Household: 5% (6% in 2024)

- Different: 3% (2% in 2024)

One space that fell beneath the 2024 common for the Prime 50 Contractors, was that in 2025 they earned a median of 25% of their product sales working as a subcontractor, a drop of two%. However that’s nonetheless a rise over TC 2023’s earlier excessive of 24% and continues the upward development from TC 2022’s 17%.