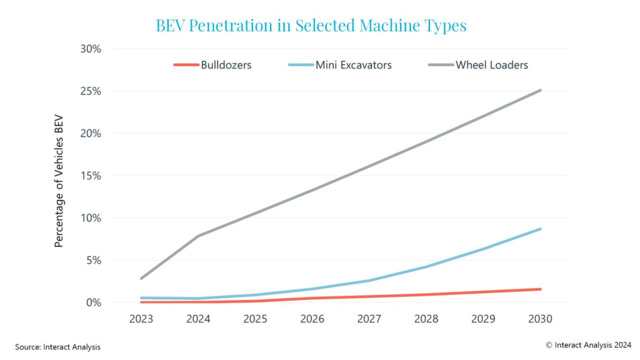

Most sorts of off-highway gear don’t but have the gross sales volumes relating to electrification which can be seen in automobiles, vans and buses. The market is at an earlier stage and progress is prone to be very excessive however ranging from a really low level. This implies the anticipated progress shall be “lumpy” (i.e. with ups and downs and a few areas/gear varieties rising strongly, whereas others stay caught at a really low stage). The speed of progress depends upon numerous elements corresponding to accessible subsidies, the strategic method of some main suppliers, the provision of charging infrastructure, and the unpredictable and considerably low demand from prospects. Nonetheless, there shall be definitely be alternatives arising throughout the sector.

For instance, wheel loaders have emerged as an space of progress in off-highway electrified gear throughout 2023 and 2024, with an estimated 4,535 full electrical BEV registered in 2023 and an extra 12,080 forecast for 2024. We predict this determine will develop to over 40,000 in 2030, representing a powerful alternative for authentic gear producers (OEMs) and element producers. The vast majority of wheel loaders shall be manufactured in Asia Pacific (led by China), with some market progress in Europe. Exterior of China and Europe, gross sales are a lot decrease. Certainly, within the Americas, electrical excavators and tractors have larger gross sales than electrical wheel loaders.

The marketplace for electrified wheel loaders is predicted to extend sharply between 2023 and 2030.Work together Evaluation

The marketplace for electrified wheel loaders is predicted to extend sharply between 2023 and 2030.Work together Evaluation

Exterior of China, progress in battery electrical automobile (BEV) wheel loader gross sales throughout 2024 has been restricted attributable to a weak building business, excessive rates of interest and a scarcity of presidency incentives. Exterior of China and Europe, there’s lack of each consciousness and product availability, with gross sales are struggling to get off the beginning line.

Alternatively, Asia Pacific gross sales of wheel loaders have grown sharply in 2024. Electrified wheel loaders have a a lot bigger share of the whole wheel loader market in China than elsewhere. In Europe (and North America) mini excavators are thought-about to be simpler to impress, as much less power is used throughout the working day and the smaller batteries are simpler to cost than specialty high-power chargers.

One cause for the upper share of electrified wheel loaders in China is that they’re generally used the place there’s a shorter working cycle. Moreover, main prospects for electrical loaders in China are considered within the metal, coal, mining and cement industries the place there’s extra strain for emission reductions. In China, all main loader OEMs have electrical wheel loaders. Chinese language distributors are actually more and more selling their merchandise elsewhere, with wheel loaders such because the Luigong 820TW and bigger 870HE offered in Europe this 12 months. Liebherr additionally offered the L 507E throughout the final 12 months, including to the present merchandise accessible from Big/Tobroco, Avant, Wacker Neuson, Volvo, JCB and others.

International revenues for powertrain elements in electrified wheel loaders (together with battery packs) are projected to succeed in $450 million in 2024. Battery packs account for $140 million of the whole, with the market measurement for motors (together with electrical motors in diesel-electric wheel loaders) anticipated to be an analogous quantity. Inverters additionally contribute considerably to the powertrain worth, with onboard chargers and dc/dc converters including a smaller quantity. The one automobile varieties we cowl in our Off-Freeway Powertrain report with larger projected 2024 income than wheel loaders (for electrified automobile elements) are forklifts and scissor lifts, that are extra commoditized markets with decrease revenue margins.

Revenues for elements in electrified wheel loaders will develop slowly as value erosion offsets a number of the progress in automobile numbers and the vast majority of this income shall be in Asia Pacific, particularly China. Nonetheless, even when Asia Pacific is excluded, income will nonetheless be larger than all different classes apart from forklifts, scissors and increase, the place are excessive charges of electrification.

Electrification numbers in off-highway could seem fairly modest for now, however it’s just the start. Firms with the fitting merchandise in 2025 to 2026 shall be finest positioned to emerge on the entrance of the queue in 2030 to 2035 when volumes are larger. In the long run, we expect a really excessive share of off-highway gear will electrify, particularly compact gear. It’s necessary to issue within the time not simply to analysis and develop product, but additionally for the training curve close to buyer wants, charging infrastructure, coping with regulators, and different elements. The winners of huge market shares post-2030 are taking motion now to make sure that they’re prepared.

Wheel loaders is simply one of many gear classes in our complete Off-Freeway Powertrain report. The others are bulldozers (crawler loader and crawler dozer), excavators (mini, small, medium and enormous), backhoe loaders, skid steer/compact tracked loaders and underground load haul dump, scissors, increase, tractors, combines, telehandlers, haul dump vans and forklifts. The report has forecasts of autos and elements by powertrain, voltage and area.