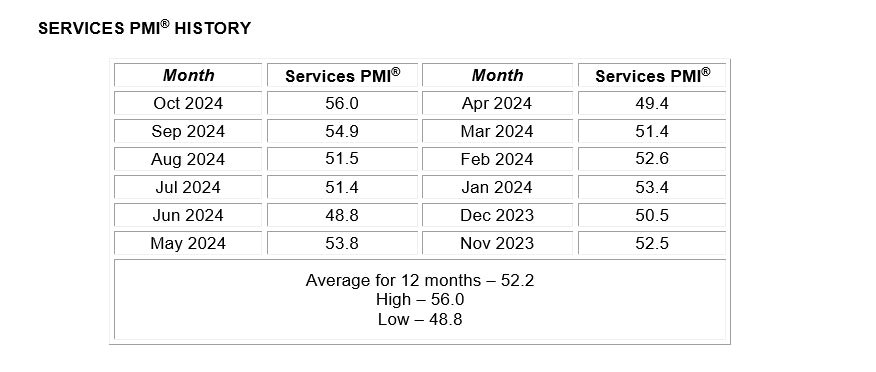

October’s ISM PSI Services Index is off 4.5 percent items from two months prior.

August was 51.5 %, September was 54.9 % and October’s was at 56 %.

Based on interviews with industry professionals in the service sector, including those in construction, the Institute for Supply Management ( ISM) Report on Business steps economic growth and attitude. A reading higher than 49 means the economy is expanding. Some of those studies have excerpts below.

- ” Company is good. Building queue. Professional Construction is powerful. Commercial Service is active. All different regions are level”. ]Construction ]

- ” Hurricane effects have affected provider sales”. ]Real Estate, Rental &, Leasing]

- ” Business is booming, little slowing down. Prices continue to increase somewhat”. ]Utilities ]

October’s 56 % reading is the highest since July 2022.

The statement was issued immediately by Steve Miller, head of the ISM Services Business Survey Committee:

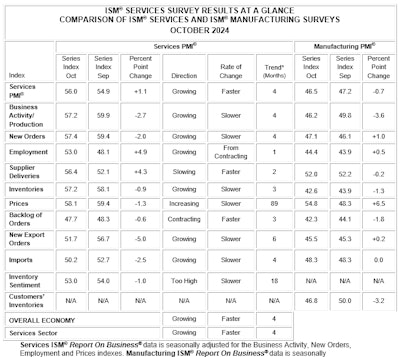

” In October, the Services PMI registered 56 %, 1.1 percentage points higher than September’s figure of 54.9 %”, he said. The reading in October represented the ninth day this year the composite score was in growth territory. The Business Activity Index registered 57.2 % in October, 2.7 percentage points lower than the 59.9 % recorded in September, indicating a fourth month of expansion after a contraction in June. The New Orders Index decreased to 57.4 % in October, 2 percentage points lower than September’s figure of 59.4 %. The Employment Index reached its third-highest reading in four months, which is a 4.9-percentage level increase from the 48.1 % recorded in September.

The Supplier Deliveries Index registered 56.4 %, 4.3 percentage points higher than the 52.1 % recorded in September. After two months in recession or “faster” province, the score remained in development place for the next month in a string, indicating slower supplier delivery results. The just ISM Report On Business score with an inverse is dealer deliveries, which indicates slower deliveries as the market improves and client demand rises.

The Prices Index registered 58.1 % in October, a 1.3-percentage point decrease from September’s reading of 59.4 %. After two consecutive months of contraction, the Inventories Index recorded 57.2 %, a decrease of 0.9 percentage points from September’s figure of 58.1 %, keeping expansion territory for a third month in October. The Inventory Sentiment Index expanded for the 18th consecutive month, but the reading of 53 %, down 1 percentage point from September’s reading of 54 %, is its lowest in that time period. The Backlog of Orders Index, which was down 0.6 % from the reading of 48.3 % in September, remained in contraction territory for a third consecutive month. It registered 47.7 % in October.

ISM

ISM

” Fourteen sectors reported progress in October, upward two from the 12 sectors reporting progress in September. The Services PMI has increased in 20 of the last 22 weeks, which date back to January 2023, and Miller noted that the reading for October is 3.7 percentage points above its 20.3 % regular for 2024.

Why the Improve?

To describe the increase in catalog statistics, Miller said:

” Both the Employment and Supplier Deliveries stocks increased by more than 4 percent factors,” according to the increase in the Services PMI in October. He claimed that both the stocks for Business Activity and New Directions dropped at least 2 percentage points. Each of the four subindexes is now over their 2024 statistics. The Supplier Deliveries Index remained in development in October, indicating slower supply efficiency. Social uncertainty was once more a topic of conversation than the previous quarter. Although some panelists noted that the longshoremen’s hit had less of an effect than feared due to its short duration, effects from hurricanes and work turbulence were often mentioned.

When it comes to the drop in New Orders, which registered 57.4 % in October, 2 percentage points lower than the reading of 59.4 percent registered in September, survey respondents said” More construction requests” and” Slightly lower due to holding back funds until after the U. S. presidential election”.

Market Performance

The 14 services industries reporting progress in October — listed in order — are: financial business, data, transportation and warehousing, accommodation and food services, finance and insurance, construction, mining, public administration, utilities, real estate, rental and leasing, educational services, expert, scientific and technical services, health care and social assistance, and retail trade. Other services, administration of businesses, and support services are the two sectors that are reporting a downturn in the month of October.